The U.S. Financial Diaries provide data on an often overlooked piece of the cash flow puzzle: loans between family and friends. Our methodology allowed us to build trust with respondents and follow nearly all of their cash flows, even those outside of formal arrangements. Informal loans are a significant piece of many households’ financial pictures.

A substantial number of households at all income levels borrowed or lent informally during the study. Chart 5.2 shows a rough trend in our sample: The use of informal loans is more common among lower-income households. Still, over 30% of households in our highest income bracket (those with an annual income at least twice the poverty threshold) reported informal financial activity.

The trend we see in informal loan use is the opposite of what we see in the use of formal loans like mortgages, car loans, and credit cards. While loans between family and friends become less common as income increases, formal loans become more common, as shown in chart 5.1.

However, our data confirm that borrowing formally and informally are not mutually exclusive. In other words, more than just the “unbanked” are using informal tools. Data in chart 5.3 indicate that a striking number of households borrowing or lending informally also have bank accounts and credit cards.

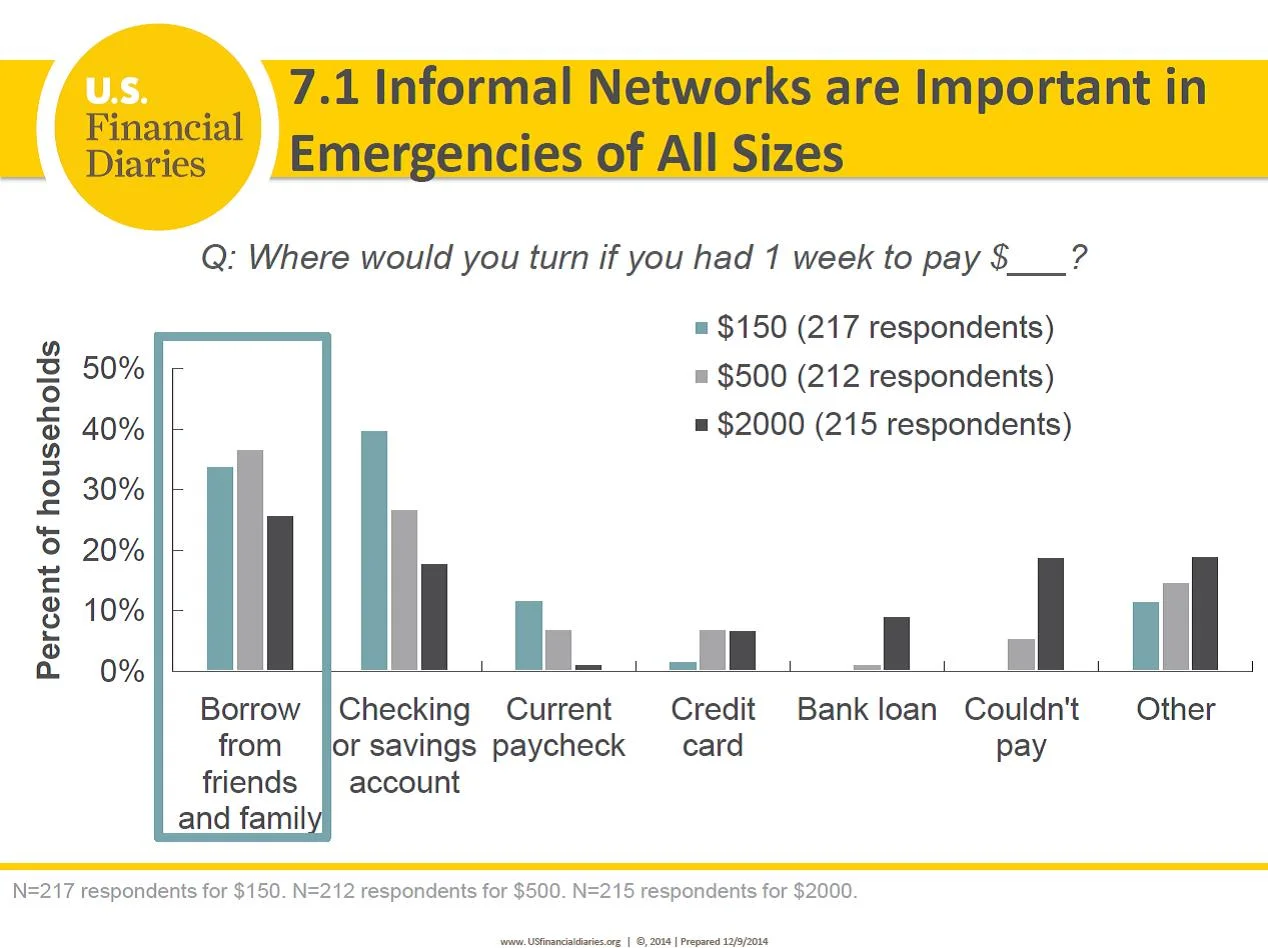

So why do households turn to informal loans even when they have access to formal financial services? Our data indicate that speed and flexibility are very important factors. For example, chart 7.1 shows that a large portion of households would first turn to their friends and family in financial emergencies.

USFD households also report that an advantage of informal loans is the ability to adjust repayment schedules if necessary. As shown in chart 7.3, 79 percent of informal loans in the study were seen as having no clear due date. Of the loans with a clear due date, chart 7.4 shows that over four-fifths of them would have at least a little flexibility if they couldn’t be repaid on time.

For a more detailed look into USFD findings on informal networks, check out An Invisible Financial Sector: How Households Use Financial Tools of Their Own Making.

This is part of a series explaining initial findings from the US Financial Diaries. The project is lead by principal investigators Jonathan Morduch (NYU) and Rachel Schneider (CFSI). Julie Siwicki was a field researcher with the project and is now a research associate. The views expressed therein are those of the author, and not necessarily of the USFD project or its funders.