One topic we were interested in when we designed the U.S. Financial Diaries was household attitudes towards both short and long-term saving. So not only did we track their cash flows into and out of savings vehicles (formal or informal), but we also asked them about their savings goals, plans, successes, and struggles.

When asked about emergency savings, the USFD families expressed a resounding desire build more of a financial cushion than they currently had in savings. Chart 4.1 illustrates the stark difference between households’ actual and ideal emergency savings balances.

Chart 4.2 shows that 45 percent of households had nothing saved for emergencies. The lack of a savings account can start to explain the difference between these families and those with at least something saved up, as shown in chart 4.3 – though we also see a correlation between higher income and having a savings account.

Our data suggest that money held in savings accounts won’t stay there long, though. In chart 4.4, 45 percent of households predicted they would spend their savings account balances within six months; 77 percent of households thought they would spend all the money in their savings account within three years. Though it may sound like this money gets spent too quickly, we’ve learned that households place a lot of value in the ability to save for the near term.

Unsurprisingly, households hope they’ll be able to leave their retirement accounts untouched for longer. Chart 4.4 shows that most – but notably not all – of the sample’s retirement accounts were predicted to keep a balance for at least the next three years.

Retirement accounts don’t show up often in our data. While 65 percent of households had a savings account, only 32% had a retirement account of any type (including 401Ks, IRAs or other protected accounts). As seen in chart 4.5, less than a third of our sample had retirement savings compared to over half of households in the United States as a whole.

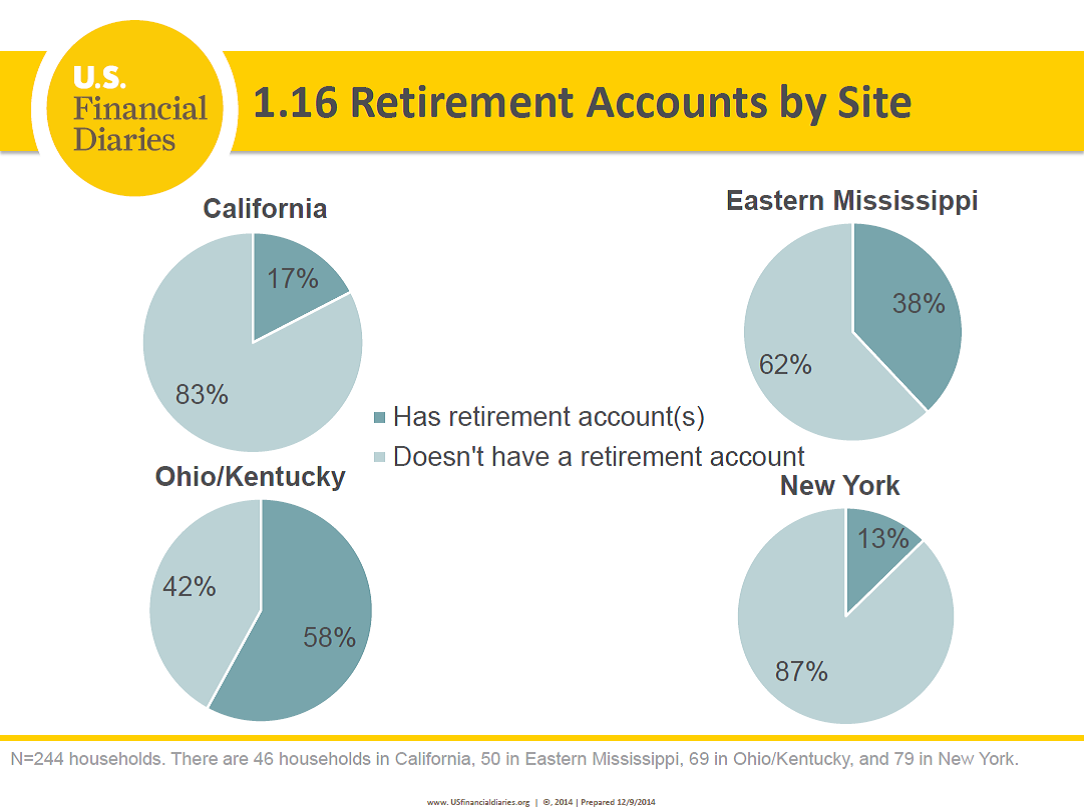

The lower-than-average incomes of households we interviewed explain a good deal of the difference. Nationally and even within our sample (see chart 4.6), poorer families have far less saved for their retirement. Immigrant status also works to determine whether or not a household has a retirement account. Chart 1.16 shows that in California and New York – our sites which include those who might have recently immigrated – families were extremely unlikely to have one.

This is part of a series explaining initial findings from the US Financial Diaries. The project is lead by principal investigators Jonathan Morduch (NYU) and Rachel Schneider (CFSI). Julie Siwicki was a field researcher with the project and is now a research associate. The views expressed therein are those of the author, and not necessarily of the USFD project or its funders.